Small Business

Is It Time to Look at Equipment Financing Differently?

June 5, 2024

Read Time: 2 MIN 20 SEC

When you buy commercial equipment, should you think of it as an independent, one-off transaction? Most businesspeople do. In fact,...

LEAF’s Easy Process

March 29, 2023

Read Time: 1 MIN 00 SEC

Finance equipment for your business is easy with LEAF. How easy? See just how simple the process is in our...

Five Quick Tips for Spending Wisely on Business Technology

March 2, 2023

Read Time: 1 min 00 sec

Struggling with the cost of staying current with business technology? On the one hand, you can’t afford to fall behind....

Cash Flow Conservation

May 27, 2022

Read Time: 3 MIN 00 SEC

Conserving cash is one of the most important aspects of running any business. Since cash is the most precious of...

Section 179

April 2, 2022

Read Time: 12 MIN 00 SEC

Section 179, the IRS Tax Code that allows a business to deduct the total cost of certain types of equipment...

Ten Things to Look for in a Small Business Financing Solution

June 10, 2021

Read Time: 2 min 00 sec

With so many options available, choosing a small business financing solution can be time consuming and frustrating, especially if you...

MPS and the Equipment Vendor Comfort Zone

September 11, 2020

Read Time: 2 min 45 sec

When evaluating their marketplace, equipment vendors and their sales teams often fall into patterns of past experience that can limit...

How to Run a Great Sales Contest

August 21, 2020

Read Time: 2 MIN 00 SEC

Salespeople love to win. It’s not enough to be good – they want to be the best. That drive can...

Six Tips to Build Business Credit

January 13, 2020

Read Time: 2 min 00 sec

Credit is a funny thing. Or maybe not so much funny as titanically frustrating. If you really need credit, it’s...

When It Comes to Financing Equipment, Asking for Help Can Be a Good Thing

July 11, 2019

Read Time: 1 min 30 sec

As a small business owner, you’ve probably been a little underwhelmed by how little some finance alternatives may know about...

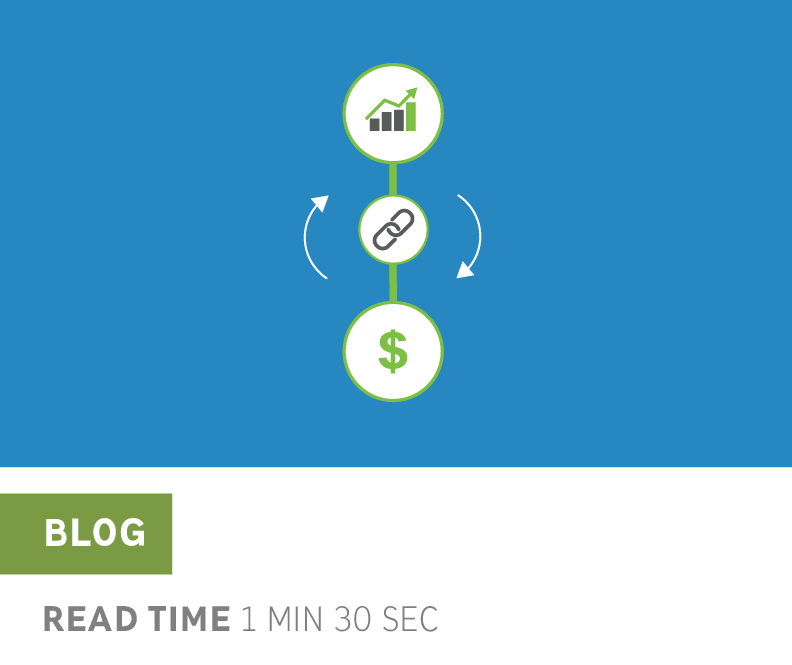

The Link Between Rapid Business Growth and Equipment Financing

February 6, 2019

Read Time: 1 MIN 30 SEC

If you had to buy your next personal vehicle with cash on hand, what kind of vehicle would you drive?...